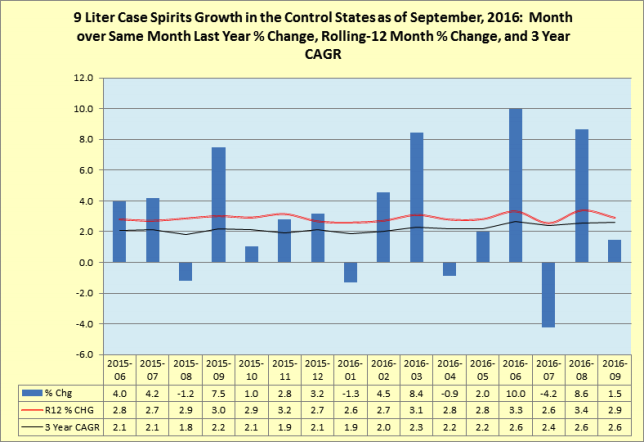

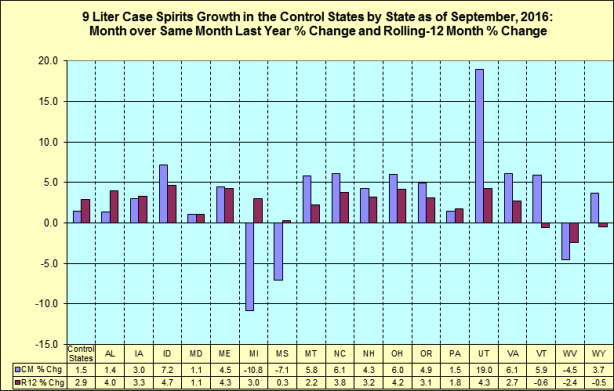

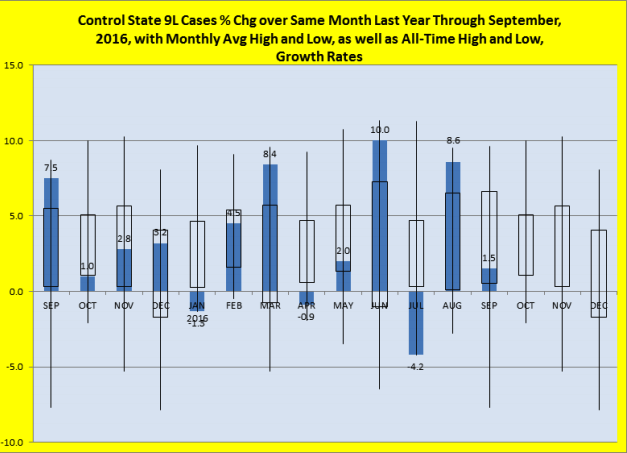

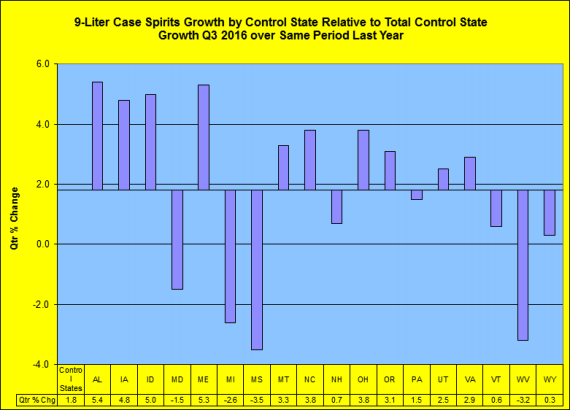

During September, nine-liter spirits case sales in the control states grew at 1.5%, a rate effected by reporting calendar anomalies and a strong comp. Rolling-twelve month volume growth of 2.9% was down from August’s 3.4%. Idaho, Maine, Montana, New Hampshire, North Carolina, Ohio, Oregon, Utah, Virginia, Vermont, and Wyoming reported monthly nine-liter case growth rates that exceeded their 12-month trends. Spirits volumes in the control states have grown 3.1% year-to-date compared to 2.8% a year ago.

Control state spirits shelf dollars growth was up 3.7% during September while trending at 5.3% during the past twelve months. Idaho, Montana, New Hampshire, North Carolina, Ohio, Oregon, Utah, Virginia, Vermont, and Wyoming reported monthly growth rates exceeding their 12-month trends. Spirits shelf dollars have grown 5.4% year-to-date, flat with 2015’s September.

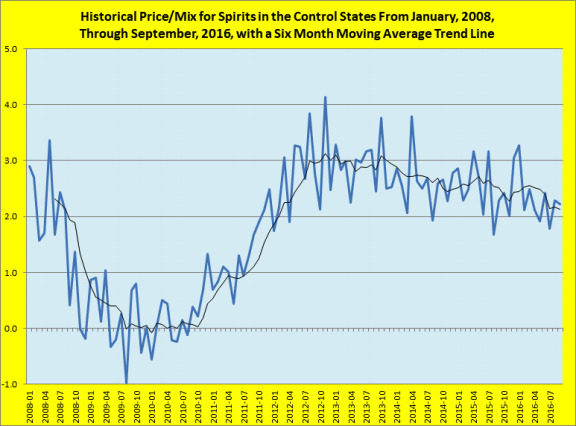

Price/Mix for September is 2.2%, nearly mirroring August’s 2.3%

September’s control state spirits growth rate was effected by the control states’ reporting calendars:

- Michigan, with more than 15% of control states’ spirits nine-liter case volumes and dollars, reported four weeks of sales this year versus five weeks of sales during September, 2015, artificially deflating growth and skewing control states results. Michigan had five fewer selling days during this year’s September than during last year’s.

- Utah, with more than 2% of control states’ spirits nine-liter case volumes and dollars, reported five weeks of sales this year versus four weeks of sales during September, 2015, artificially inflating growth and skewing control states results. Utah had six more selling days during this year’s September than during last year’s.

- Overall, September, 2016, had one more selling day than last year’s September.

- After equivalizing nine-liter spirits case sales with respect to selling-day variations, September’s volumetric growth is 3.4%, and rolling-twelve-month volume growth is 2.6%. Likewise, after equivalizing shelf dollars, September’s control states shelf dollar growth rate is 5.9% with a twelve-month trend of 4.9%.

- April’s equivalized Price/Mix is 2.5%.

Irish Whiskey, with 1% share of the control states spirits market, was September’s fastest growing category with 12.0% reported and a twelve month trend of 15.1%. Vodka, with 35% share, grew during the same periods at 0.9% and 2.9%. Tequila (8.9%) grew during September at a rate exceeding its twelve-month trend, while Brandy/Cognac (9.9%), Canadian Whiskey (1.5%), Cocktails (-1.0%), Cordials (-2.7%), Domestic Whiskey (2.4%), Gin (-1.1%), Irish Whiskey (12.0%), Rum (-0.9%), Scotch (-1.2%), and Vodka (0.9%) fell somewhat short.

September’s nine-liter wine case sales growth rate was 2.5%. Pennsylvania (reporting 2.5% nine-liter case growth for wines), New Hampshire (1.7%), Utah (21.5%), Mississippi (-9.5%), Montgomery County Maryland (-1.1%), and Wyoming (0.4%) are the control states that are the sole wholesalers of wines and spirits within their geographical boundaries. Rolling-twelve month wine volume growth in these six control states was 1.7%, lagging August’s 1.9%.

| 9L Cases CM % Chg | Shelf $ CM % Chg | Price/Mix | Control States | |

|---|---|---|---|---|

| Total Control States | 1.5 | 3.7 | 2.2 | |

| Central Region | -1.7 | -0.2 | 1.5 | IA, MD, MI, OH, PA, WV |

| NE Region | 4.5 | 9.0 | 4.5 | ME, NH, VT |

| NW Region | 7.7 | 9.5 | 1.8 | ID, MT, OR, UT, WY |

| Southern Region | 3.3 | 6.6 | 3.3 | AL, MS, NC, VA |

For more information about the NABCA, visit www.nabca.org.

###

ABOUT NABCA:

Established in 1938, NABCA is the national association representing the Control State Systems - those jurisdictions that directly control the distribution and sale of beverage alcohol within their borders. Headquartered in Alexandria, VA, NABCA’s mission is to support member jurisdictions in their efforts to protect public health and safety and assure responsible and efficient systems for beverage alcohol distribution and sales.